The Business of Mindfulness Meditation: How Apps like Calm and Headspace are Cashing In

The landscape of meditation apps, key features, distribution, and the future

In this edition of The Discourse, I cover the gamut of meditation apps.

My personal meditation journey started back in 2013. I was preparing for my second attempt at the GMAT, and I read a research study on how mindfulness meditation improved test scores. And just a year before, I had an unsuccessful attempt at the GMAT, mostly because my mind was wandering during the test. So I started meditating for 20 minutes daily for the next 30 days straight until my test. It reduced my mind-wandering, kept me focused, and I ended up getting an excellent score. And a large part of it was down to meditation. I've tried to be consistent ever since.

Before we start, if you’re new here, please subscribe and get insights about product, design, no-code delivered to your inbox every week.

So, what is mindfulness? Mindfulness is nothing but the non-judgmental awareness of the present moment.

Then how is mindfulness different from meditation? Meditation is a practice where you use a technique, often mindfulness, to train attention and awareness. There are other types of meditations like transcendental, mantra, focussed meditation that serve different purposes.

A meta-analysis of randomized clinical trials has proven the benefits of mindfulness and meditation towards the reduction of psychological stress, anxiety, and depression.

An ancient Indian practice is now the battleground for the tech space. So take a moment to get comfortable, nice soft focus, take a deep breath in, and let's start!

Market and Players

The meditation market is valued at $1.2B, and estimated to grow to $5B by 2025 with a CAGR of 41%. There are 2 leading players — Calm and Headspace, with a distant third of Insight Timer. There are other smaller players like Waking Up by Sam Harris, Aur, Breethe, Balance, Simple Habit, and so on.

It’s a crowded space, but I don’t think there will be a winner-takes-all like ecommerce. People will have their own preferred meditation app based on the content available and the subjective preference of the narrator’s voice.

Content

While not exactly like the entertainment streaming industry, I do see some similarities in the approach.

Calm and Headspace started off with original content - mostly produced by Andy Puddicombe (Founder of Headspace) and Tamara Levitt (Head of Mindfulness at Calm).

Now, Calm and to a lesser extent Headspace have licensing deals with publishers. For example, Calm has collaborated with Lebron James, Stephen Fry, and Harry Styles. Headspace has curated focus playlists by Hans Zimmer and Sudan. Just like Netflix or Disney+, it’s either original content or licensed deals.

On the other hand, Insight Timer is similar to YouTube. There are thousands of individual practitioners that can publish their own meditation audio. They’ve also recently launched live streaming. This can create a middle class of creators with individual publisher’s own audience and following.

Both types operate on freemium plans — free with a limited selection and a catalog that is unlocked after paying. Insight Timer also has a donation plan to support independent publishers, similar to YouTube’s superchat and membership offering.

How many users do they have?

Calm: 60M

Headspace: 42M

Insight Timer: 7M+ (Here is where Insight Timer differs from YouTube)

Annual Revenues:

Calm - $150M (2019)

Headspace - $100M (2019)

Insight Timer - $400K (estimated)

Whereas, when you look at the entertainment streaming industry:

Netflix - $20B [source]

Disney streaming - ~$6B (Having only launched in Nov 2019) [source]

YouTube - $15B [source]

It’s clear that there’s a disparity in the scale of revenue. Meditation as a behavior and habit has only come to the forefront in the last 10 years as more research has proved its benefits.

Product Features

Guided Audio Meditation

You are guided through meditation through audio, while you keep your eyes closed.

Both Headspace and Calm have two predominant voices — Andy Puddicombe in Headspace and Tamara Levitt in Calm. Preference for either of their voices is entirely subjective. I personally prefer Andy’s voice as I find it more soothing.

Insight Timer, on the other hand, has a large collection of independent practitioners.

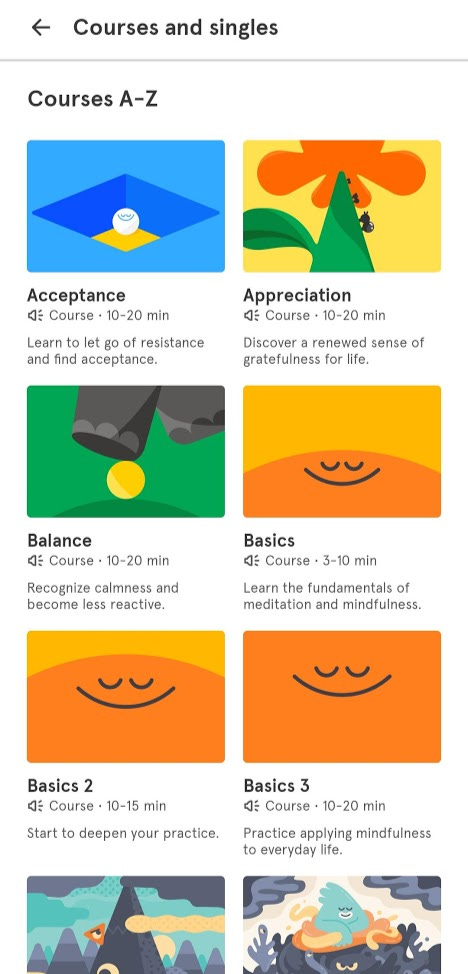

The audios are categorized according to themes related to stress, anxiety, sports, focus, and so on.

Most of the meditations on Calm and Headspace are 10 minutes long. Insight Timer takes it further with longer meditations - 15 to 25 minutes in duration. As I’ve continued my journey in meditation, I find that longer meditations lead to more beneficial sessions.

Sleep Stories

In addition to different meditations, they also have sleep stories that put you off to sleep with soothing narration about a calming topic. I got hooked onto Stephen Fry’s soothing narration of ‘Blue Gold’ and can probably recite it in my sleep.

Sleep is a booming space, especially with the pandemic wreaking havoc on our sleep patterns. I recently came across loóna, a sleepscape app that combines soundscapes with relaxing activities.

Social

Meditation is intrinsically a single-player game, but it can be played in multiplayer mode as well - just like a group yoga session. Yoga is nothing but asanas + meditation.

They also take into account the social aspect of human behavior. In their paid version, they have group meditations. Here, they just tell you that these many people across the world are meditating.

Habit Building

Meditation is a habit, just like exercise. So for it to stick, you need to include habit forming devices — streaks, milestones, social accountability, and so on. What makes this attractive for investors is that it is a DAU product.

Headspace, Calm, and Insight Timer provide total time meditated, sessions completed, longest streaks to build a habit.

Headspace has buddies that you can add, Insight Timer shows a world map of everyone meditating at the same time. They have also added a ‘groups feature’ that lets you add your friends to plan group meditations. Calm, on the other hand, doesn’t have many social features.

Aesthetics

From an aesthetics point of view, a meditation app benefits from visuals that are calming, pleasing, and fun. Headspace has fun cartoonish blobs and colorful visuals to make it fun to use. Calm and Insight Timer includes pictures of people and elements from nature.

I took cues from Calm to include pleasing nature Gifs in Mind Health, an app that I built to improve my own mental health through cognitive-behavioral therapy and meditation.

Paradox of choice

Meditation apps suffer from a Netflix-esque paradox of choice. More often than not, you are stuck deciding which meditation to do before proceeding.

Here's how I tried to solve it:

Marketing and Distribution

Consumer

Headspace and Calm both began as consumer apps. Their popularity rode on the strength of their product. Headspace has been regularly featured on the App Store and Calm won the iPhone App of the Year in 2017 and Google Plays’ Editors’ Choice in 2018.

Andy Puddicombe, the founder of Headspace, had a hugely popular Ted Talk in 2012 and has featured in multiple podcasts to promote the app.

Now their approach is vastly different. Calm sponsored CNN’s coverage of the 2020 US Elections and it was hilarious. It was a surreal blend of mindfulness, capitalism, and politics. But it seemed to have worked to boost Calm’s downloads.

Business

Due to the tailwinds of Covid, more companies will invest in the mental health of their employees. Companies will take some of the cost savings from lavish office spends and invest in wellness programs for employees.

Both Calm and Headspace offer plans for businesses:

So they are going the Team approach, which will help them increase retention and revenues. David Sacks talked about this in Teams vs individuals.

As an added feature for teams, they offer analytics on top of the app to track engagement rates.

However, I think there is scope for more features. Their teams plan should not just be a collection of individual plans with analytics slapped on top. It should involve the team together in activities, for instance, through group meditation.

Competition from existing audio players

YouTube being the all-encompassing platform, offers meditation videos too. Some of the top meditation videos have views in the tens of millions. Some % of the market is captured by YouTube.

But the elephant that's not in the room is Spotify.

Spotify wants to be the be-all in audio. Spotify got into the podcast space almost ten years after the podcast industry was launched by Apple. But they took it by storm by acquiring Gimlet Media, Anchor, Parcast, and the Ringer. And the $100M license deal for Joe Rogan's show.

Now, there are guided meditation playlists curated by Spotify but nothing more than that.

When I asked users on Twitter and Slack groups, most people said that they had little intent to switch to another app. Unless there was a major innovation, maybe something like VR. Turns out it isn’t too far from reality.

Another lock-in is the narrator's voice. There is a sense of familiarity that comes along with the voices. It’s personal. This is hard to replicate for new entrants, so it might be difficult to get people to switch.

The habit features can be replicated by others easily, but it’ll take some product thinking to include it in the existing apps like YouTube or Spotify.

Will Spotify take a stab at capturing this space in the future? Quite possibly.

📱Related App: Mind Health

In case you’re interested in checking out the no-code app I built for cognitive-behavioral therapy and meditation. Feedback is always appreciated.

📘 Read of the week: Tobi Lütke - The Observer Effect

Tobi is the founder of Shopify who has a wide-ranging expertise on a number of topics. He famously advocates for using video games, especially Factorio, as a way to learn business concepts. It’s a very long read, so consume it in parts.

That's it for today, thanks for reading! Press the ♥️ button if you liked this edition. Have any questions? Leave a comment below, and I'll be happy to answer them.

Talk to you soon!

— Kavir

P.S. Hit the subscribe button if you liked it! You’ll get insightful posts like this directly in your email inbox every week.

Given that they offer largely the same product, it'd be interesting to see their potential for growth. Do they users just stick to the first app they used? That case it might mean that the market is very entrenched